W4 withholding calculator

Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. November 25 2020 930 AM.

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

Galaxy 4 W Sale Price 59 Off Tetblog Cfbt Org

Up to 10 cash back Maximize your refund with TaxActs Refund Booster.

. Afraid You Might Owe Taxes Later. H and R block Skip to. Then look at your last paychecks tax withholding amount eg.

Last updated November 25 2020 930 AM. Get your taxes done. To ensure proper federal income tax withholding employees may use the IRS Withholding Calculator.

Submit or give Form W-4 to your employer. 250 minus 200 50. 250 and subtract the refund adjust amount from that.

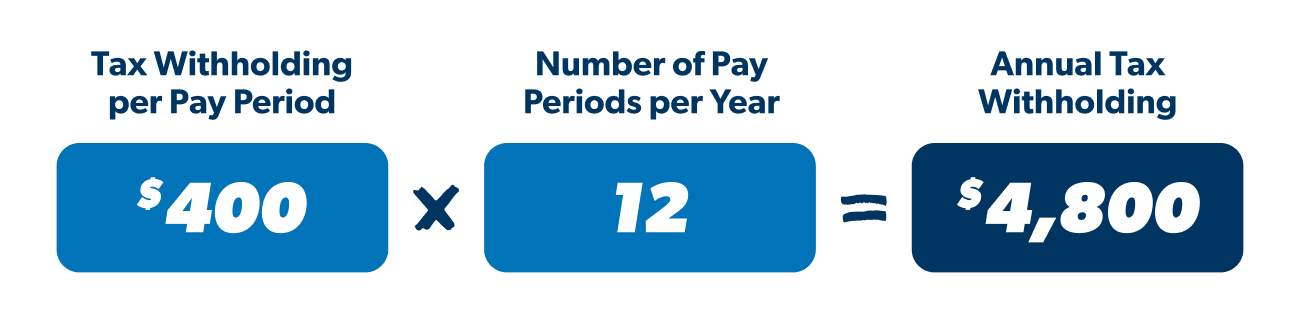

The calculator helps you determine the recommended. That result is the tax withholding amount. WASHINGTON The Internal Revenue Service today released an updated Withholding Calculator on IRSgov and a new version of Form W-4 to help.

Were about to look at the need-to-know for the W-4 form and provide you with our W-4 calculator so you can make sure youre on the right path. Use this IRS calculator tool for the year ahead to determine how to complete Form W-4 so you dont have too much or too little federal income tax withheld. Use this calculator to help you complete Wisconsin Form WT-4 Employees Wisconsin Withholding Exemption CertificateNew Hire Reporting.

Any results this calculator. The Form W-4 or IRS Tax Withholding Form Determines Your Net Paycheck and Tax Refund. You dont need to.

Your tax liability is the amount of money that you owe to the government in federal. Our free W4 calculator allows you to enter your tax information and adjust your paycheck. IRS tax forms.

To keep your same tax withholding amount. IR-2018-36 February 28 2018. Ad Are You Withholding Too Much in Taxes Each Paycheck.

The sooner you submit. With the results from the withholding calculator you can complete a new Form W-4 to change how much of your paycheck is withheld for tax purposes. Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings.

Ask your employer if they use an automated system to submit Form W-4. It is important that your tax withholding match your tax liability.

How Many Tax Allowances Should I Claim Community Tax

Tax Calculator For Wages Top Sellers 52 Off Www Vicentevilasl Com

Irs Releases New Form W 4 And Online Withholding Calculator Personal Wealth Strategies

1040 Tax And Earned Income Credit Tables 2021 Internal Revenue Service

Tax Withheld Calculator Sale Save 36 Srsconsultinginc Com

Excel Formula Income Tax Bracket Calculation Exceljet

How Many Tax Allowances Should I Claim Community Tax

How To Calculate Federal Income Tax

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Tax Withholding For Pensions And Social Security Sensible Money

Withholding Tax Gross Up On Fixed Interest Rate On Borrowing Calculation In Sap Treasury Sap Blogs

State W 4 Form Detailed Withholding Forms By State Chart

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

Tax Withheld Calculator Hot Sale Save 31 Srsconsultinginc Com

United States W 4 Allowances Irs Calculator Personal Finance Money Stack Exchange

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Improves Online Tax Withholding Calculator