46+ Irs Installment Agreement While In Chapter 7

Are described in Table 5-1 see chapter 5. A Qualified Intermediary QI is an eligible person that enters into a QI Agreement with the IRS pursuant to Rev.

Keeping An Irs Installment Plan In Chapter 13 Bankruptcy Tips

Modification as used in this subpart means a minor change in the details of a provision or clause that is specifically authorized by the FAR and does not alter the substance of the provision or clause see 52104.

. The collection of information in this revenue procedure is in Section 403 and Sections 5 through 7. AmendFix Return Form 2848. Request for Taxpayer Identification Number TIN and Certification.

Within a single year some unmarketable assets may be valued by a qualified appraiser while others are. Web Comments and suggestions. In September 2020 just before the 2020 general election Californians were also divided 47 optimistic 49 pessimistic.

Microsoft describes the CMAs concerns as misplaced and says that. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax. Web Installment Agreement Request POPULAR FOR TAX PROS.

Individual Tax Return Form 1040 Instructions. In chapter 1 of Pub. AmendFix Return Form 2848.

Web Comments and suggestions. Web Installment Agreement Request POPULAR FOR TAX PROS. See How Do You Recharacterize a Contribution.

The information will help. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Agar aidar car dear diar dolar.

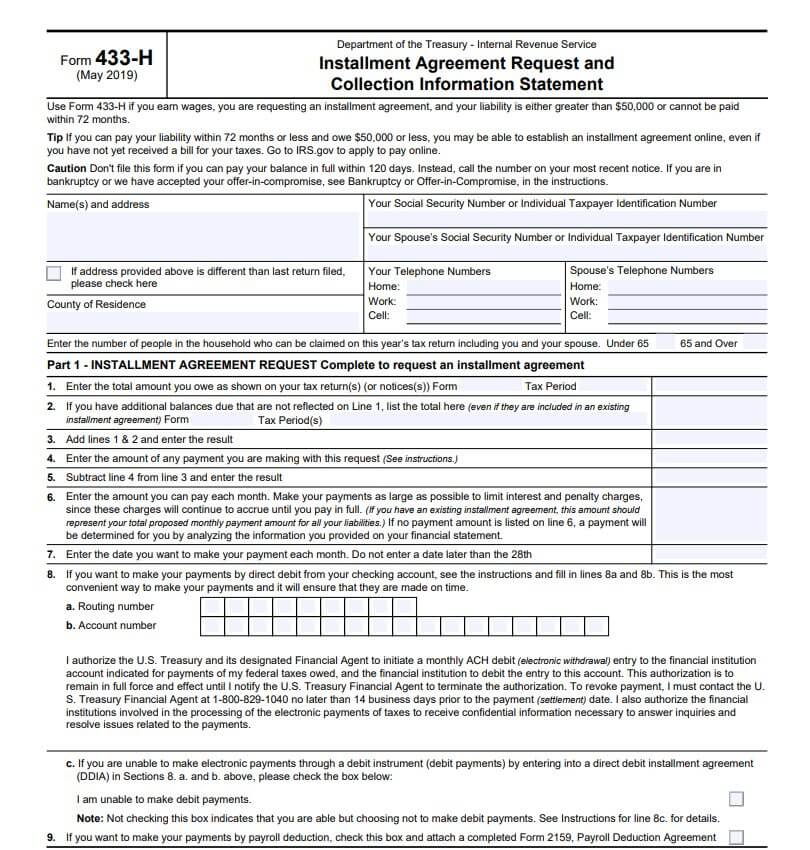

Subtract line 7 from line 6. Or an installment agreement that will allow you to pay your taxes over an extended period. Additional IRS applications will transition to the new method over the next year.

While others have required the absence of both. Enter any installment sale income reported in prior years 24000. If you were unable to leave the United States due to COVID-19 travel disruptions you may be eligible to exclude up to 60.

The IRS will not conduct examinations covering insurance excise tax liabilities arising under the four situations set forth in Rev. Web chapter 99 cas row 2. Web Comments and suggestions.

Web Installment Agreement Request POPULAR FOR TAX PROS. AmendFix Return Form 2848. Web Installment Agreement Request POPULAR FOR TAX PROS.

AmendFix Return Form 2848. Dfars dfarspgi afars affars dars dlad nmcars sofars transfars row 3. AmendFix Return Form 2848.

Days you are unable to leave the United States because of a medical condition that arose while you are in the United States. Business Tax Returns and Non-Master File Accounts. AmendFix Return Form 2848.

AmendFix Return Form 2848. We welcome your comments about this publication and suggestions for future editions. If you have one expense that includes the costs of non-entertainment-related meals entertainment and other services such as lodging or transportation you must allocate that expense between the cost of.

You must also include a statement that indicates you filed a chapter 11 case and that explains how income and withheld income tax reported to you. Web IRM 2174410 Federal Income Tax Withheld FITWBackup Withholding BUWH on Income Tax Returns. Web Microsoft pleaded for its deal on the day of the Phase 2 decision last month but now the gloves are well and truly off.

Section 1409 of the Health Care and Education Reconciliation Act of 2010 added IRC 7701o Clarification of Economic Substance Doctrine to the Code to provide clarification of the economic. Web If you file for Chapter 7 or Chapter 13 bankruptcy then the court may discharge some of your debts. Subchapter J chapter 1 subtitle A of the Code subpart E but in no event prior to the time property is first transferred to the trust.

Gain on the sale of nondepreciable personal property you sold while maintaining a tax home outside the United States if you paid a tax of at least 10 of the gain to a foreign country. Divide line 8 by line 9. Optimism has been similar in more recent years but has decreased 7 points since we first asked this question in September 2017 56.

NW IR-6526 Washington DC 20224. We welcome your comments about this publication and suggestions for future editions. Web Installment Agreement Request POPULAR FOR TAX PROS.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Web Installment Agreement Request POPULAR FOR TAX PROS. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

Web Installment Agreement Request POPULAR FOR TAX PROS. Web Installment Agreement Request POPULAR FOR TAX PROS. Schedules K-2 and K-3 are new for the 2021 tax year.

Web POPULAR FORMS. IRM 214514 Interest and Penalty Consideration for Category D Erroneous Refunds. Web Find the latest business news on Wall Street jobs and the economy the housing market personal finance and money investments and much more on ABC News.

Web Installment Agreement Request POPULAR FOR TAX PROS. 2008-15 this Bulletin or any similar fact pattern to the extent that premiums are paid or received by. Treat any earnings or loss that occurred in the first IRA as having occurred in the second IRA.

Web Installment Agreement Request POPULAR FOR TAX PROS. Subpart 522 sets forth the text of all FAR provisions and clauses each in its. IP PIN and Online Payment Agreement.

This is your new gross profit percentage 4667. Notwithstanding that the USFI does not execute an FFI agreement with respect to the chapter 4 requirements of such a branch the USFI may for accounts maintained by the branch use the procedures set forth in Annex I of the applicable Model. NW IR-6526 Washington DC 20224.

Including procedures under part 155320 of chapter 45 of the Code of Federal Regulations instead of getting return information under section 6103l21. Instructions for Form 1040 Form W-9. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

437 and that acts as a QI under such. Web Installment Agreement Request POPULAR FOR TAX PROS. AmendFix Return Form 2848.

These schedules replace supplement and clarify the former line 16 Partners Distributive Share Items Foreign Transactions of Schedule K Form 1065 and line 16 Foreign Transactions of Schedule K-1 Form 1065Schedules K-2 and K-3 also replace supplement and clarify. NW IR-6526 Washington DC 20224. Web Section 179 deduction dollar limits.

IRM 2179416 Duplicate Filing Conditions Involving Returns Prepared Under IRC 6020b. And line 45 of the Schedule D Tax Worksheet is less than. Web Forty-nine percent are optimistic while 46 percent are pessimistic.

B Numbering 1 FAR provisions and clauses. You cant deduct any loss that occurred while the funds were in the first IRA. We welcome your comments about this publication and suggestions for future editions.

Chandler Az Defaulted Irs Payment Plan Tax Debt Advisors

Irs Installment Agreement Guide On Irs Payment Plans Supermoney

Our Case Results Landmark Tax Group

How Bankruptcy Affects Tax Liens And Repayment Schedules Taxcontroversy Com

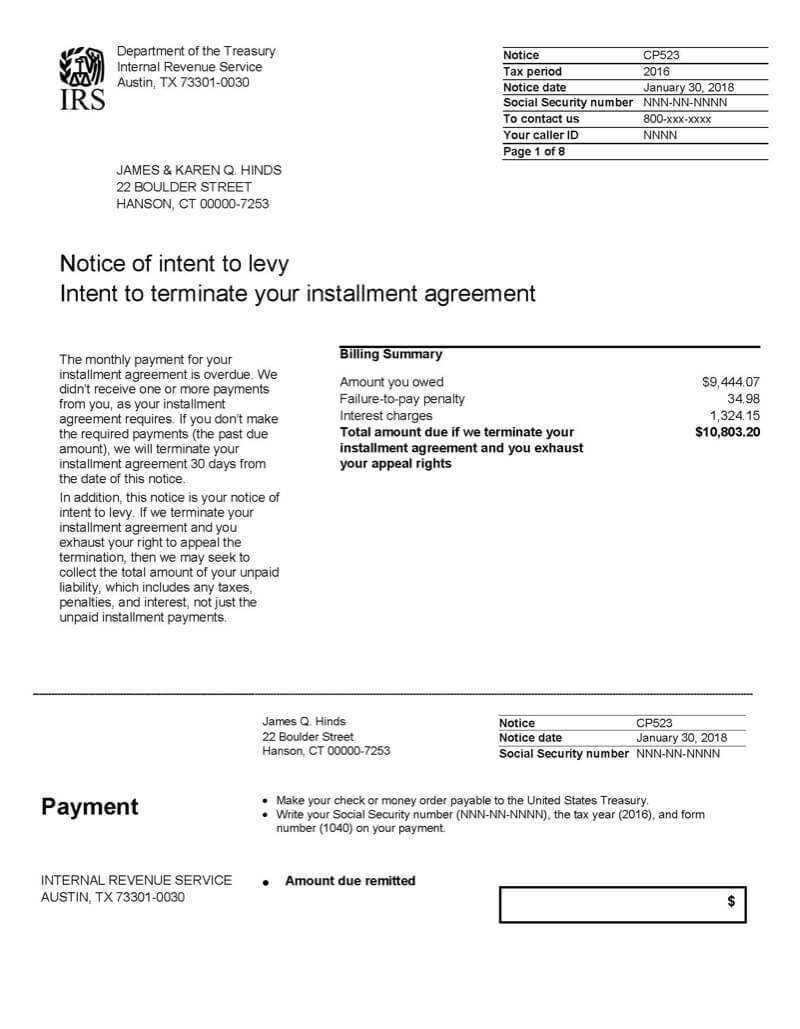

What Is A Cp523 Irs Notice Jackson Hewitt

Free 50 Form Samples In Google Docs Pages Pdf Ms Word

New Jersey Irs Payment Plans Attorney Paladini Law Jersey City

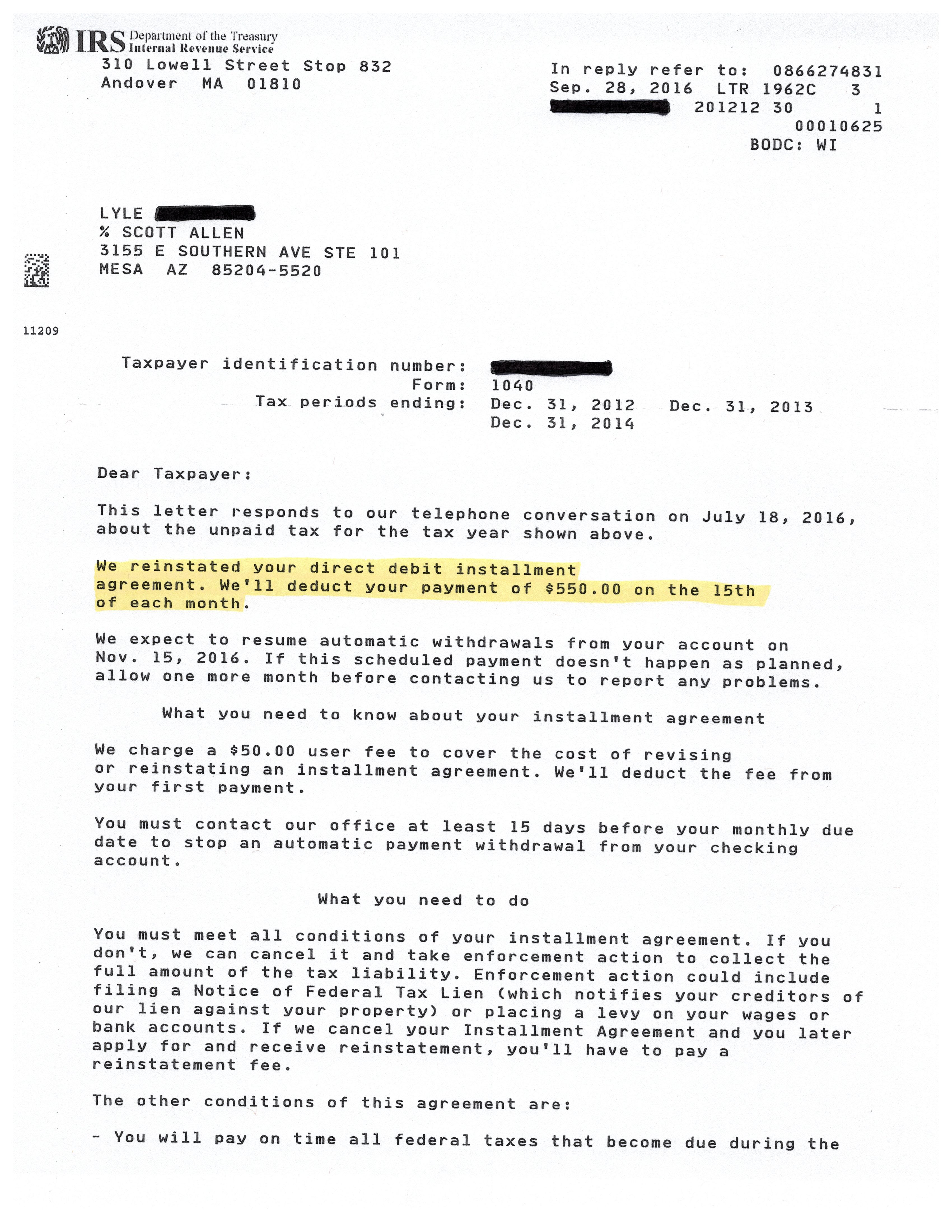

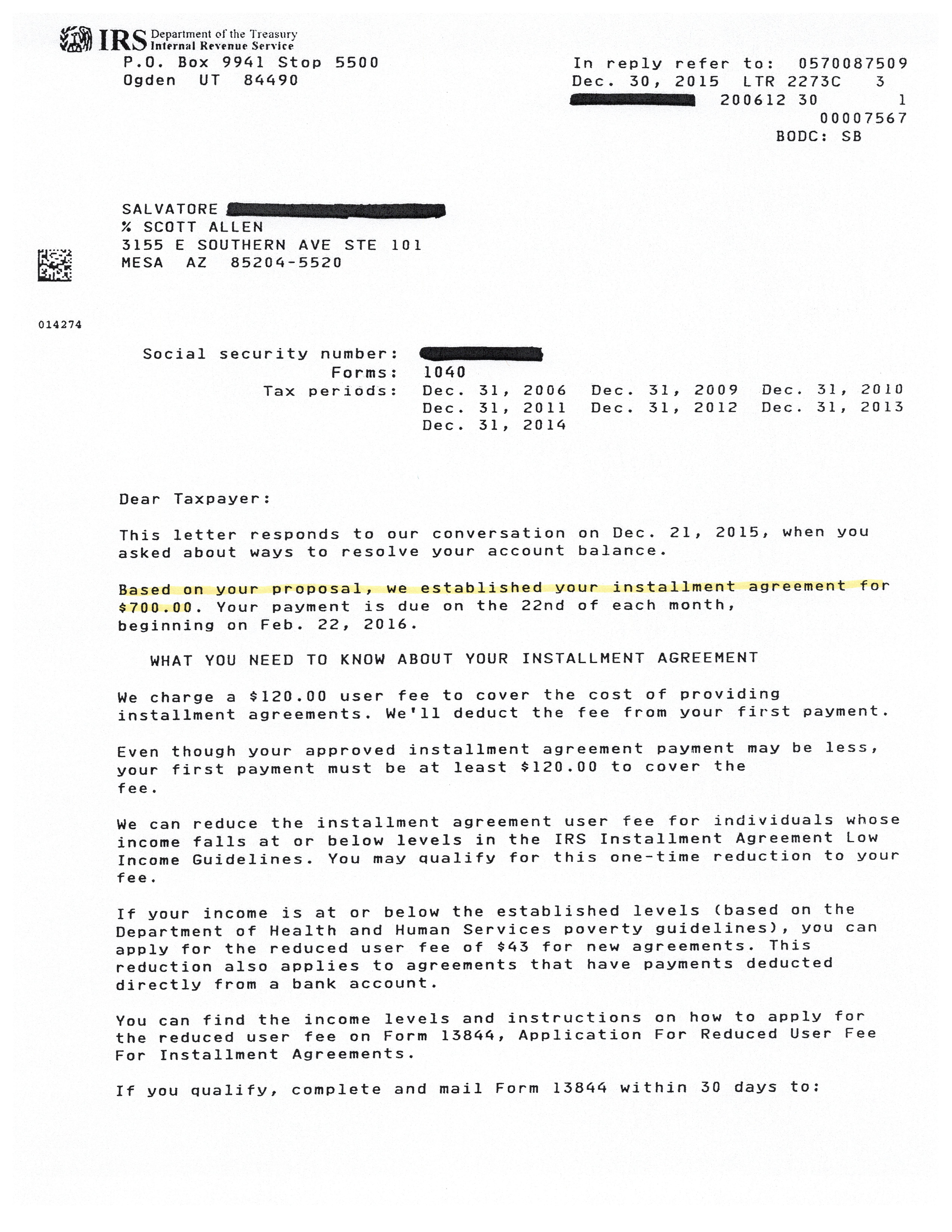

Sal And His Mesa Az Irs Installment Arrangement Tax Debt Advisors

List Of Historical Acts Of Tax Resistance Wikipedia

How A 390 459 Irs Debt Reached A 94 Settlement Landmark Tax Group

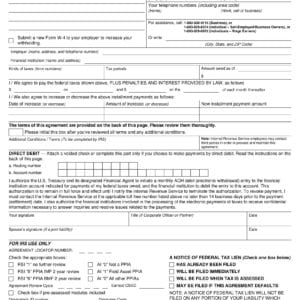

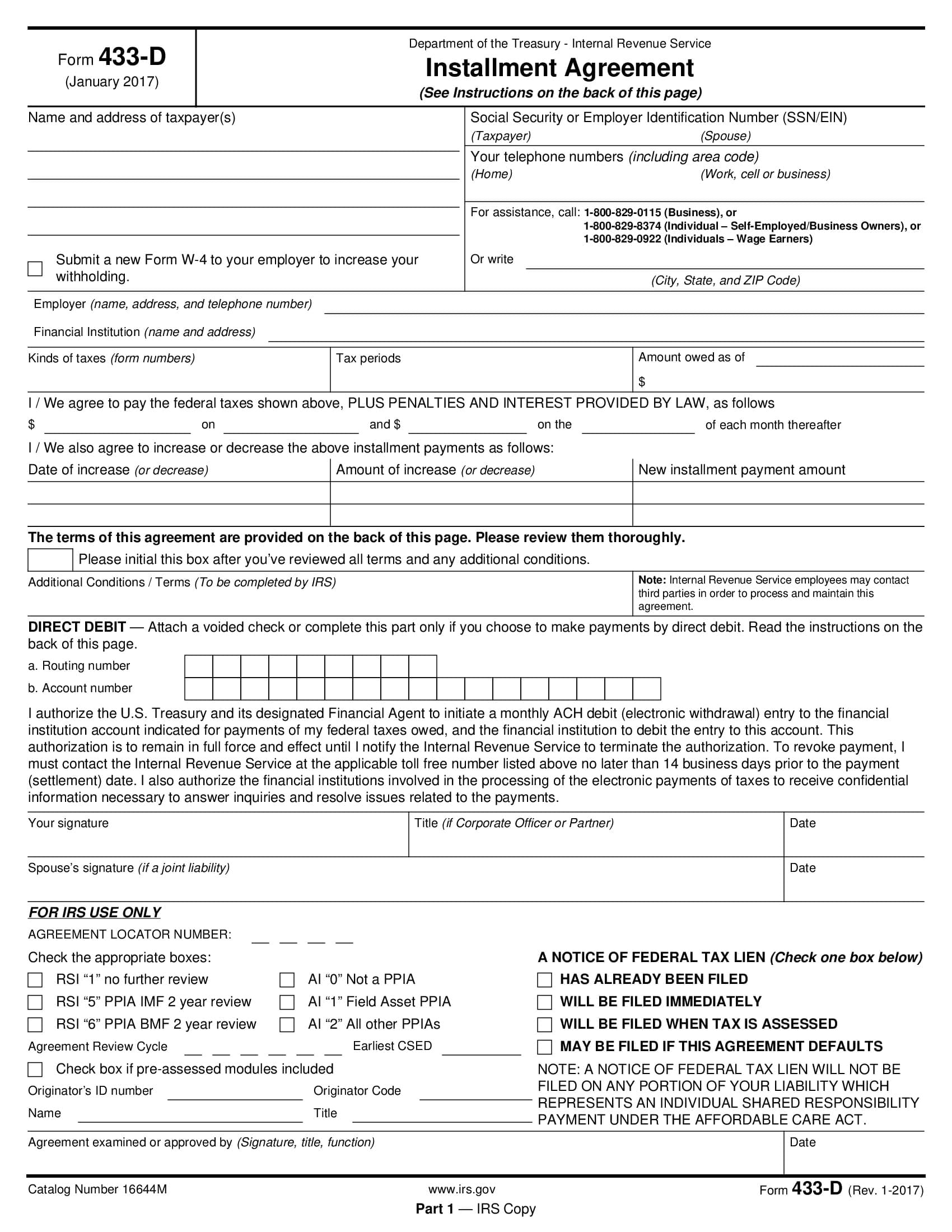

Installment Agreement Tabb Financial Services

How Bankruptcy Affects Tax Liens And Repayment Schedules Taxcontroversy Com

Installment Agreement Tabb Financial Services

How Bankruptcy Affects Tax Liens And Repayment Schedules Taxcontroversy Com

Installment Agreement Tabb Financial Services

New Jersey Irs Payment Plans Attorney Paladini Law Jersey City

Installment Agreement Tabb Financial Services